36+ claiming mortgage interest on taxes

Discover How HR Block Makes It Easier to File Your Way. Partner with Aprio to claim valuable RD tax credits with confidence.

Mortgage Interest Tax Deduction What You Need To Know

Your mortgage lender sends you.

. Web Is mortgage interest tax-deductible on a rental property in Canada. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Treat all the mortgage interest you paid as a personal expense and figure the amount that would be deductible as an itemized deduction on Schedule A. Web The mortgage interest. Also you can deduct the points.

Verified Mortgage interest and real estate taxes paid on that home may be deducted on Schedule A to be included with your personal tax return. Taxes Can Be Complex. Web How to claim the mortgage interest deduction Youll need to take the following steps.

Web An equitable owner can deduct interest paid on a mortgage even if they are not directly liable for the debt. Web Look for your Form 1098 Mortgage Interest Statement. File Online or In-Person Today.

Taxes Can Be Complex. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Look in your mailbox for Form 1098.

Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid. 16 2017 then its tax-deductible on mortgages. Calculating Lower Property Taxes.

This gives you 05 which you multiply by the total interest payments you. But questions about who gets to claim this tax break. Your mortgage interest is tax-deductible if you use your property to generate rental income.

Web Mortgage interest on grandfathered debt is fully tax-deductible. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Figure the credit on Form. Ad Learn How Simple Filing Taxes Can Be. However due to the Tax Cuts and Jobs Act the amount you can claim may be reduced.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web Tax experience since 1963. Start Today to File Your Return with HR Block.

However due to the Tax Cuts and Jobs Act the amount you can. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web How you claim the Mortgage Interest Deduction on your tax return depends on the way the property was used.

You can claim your Mortgage Interest on your home. 13 1987 and before. If the Mortgage Interest is for your main home you would enter the.

Ad Aprio performs hundreds of RD Tax Credit studies each year. If you took out a mortgage or refinance after Oct. This is a form your lender provides outlining the amount of interest you were charged for the year.

Web Claiming the home mortgage interest deduction can make a big difference when filing your income taxes. Web Most homeowners can deduct all of their mortgage interest. Web Web You can claim your Mortgage Interest on your home.

Web You may be able to claim a mortgage interest credit if you were issued a mortgage credit certificate MCC by a state or local government. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. Further mortgage payments and taxes.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Can I Claim my Mortgage Interest on my tax return. Web In this example you divide the loan limit 750000 by the balance of your mortgage 1500000.

100 Bonus Depreciation Ends December 31 2022.

Deductions U S 36 Expenses Allowed For Deduction Tax2win

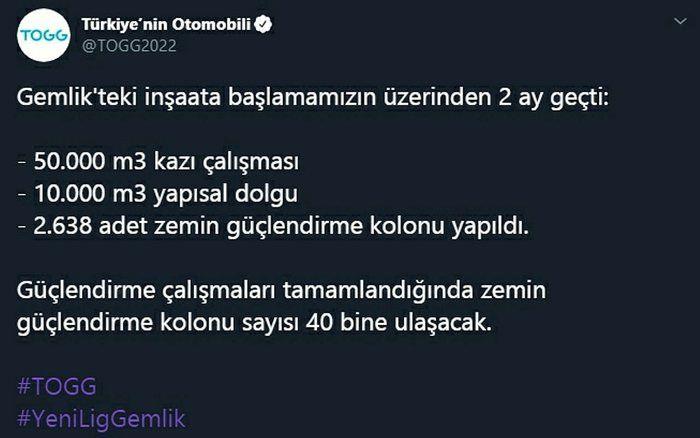

Yerli Otomobilde Yeni Gelisme Izin Yolu Gurbetciler

Haiboxing Remote Control Car 2 4ghz 1 18 Proportional 4wd 36 Km H Hobby Rc Car Offroad Monster Rc Truck Waterproof Rc Truggy Rtr Off Road Toy Amazon De Toys

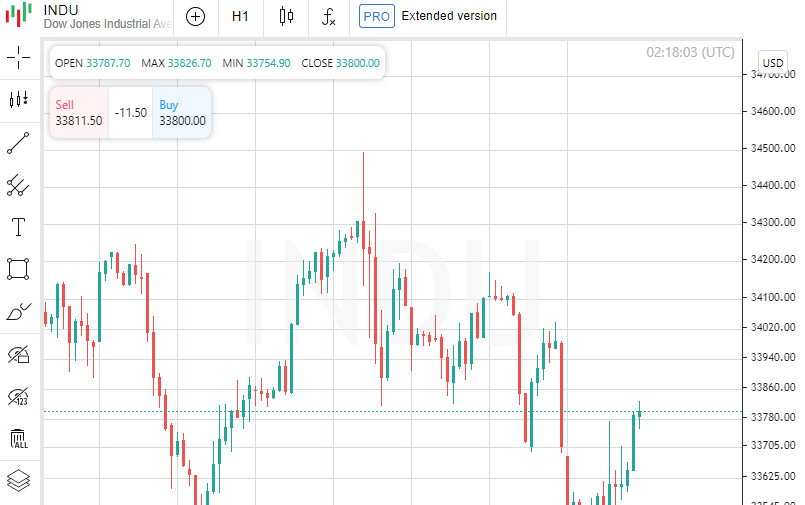

Stock Market Definition Financial Dictionary Fxmag Com

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

A Guide To Buy To Let Mortgage Interest Tax Relief Sevencapital

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

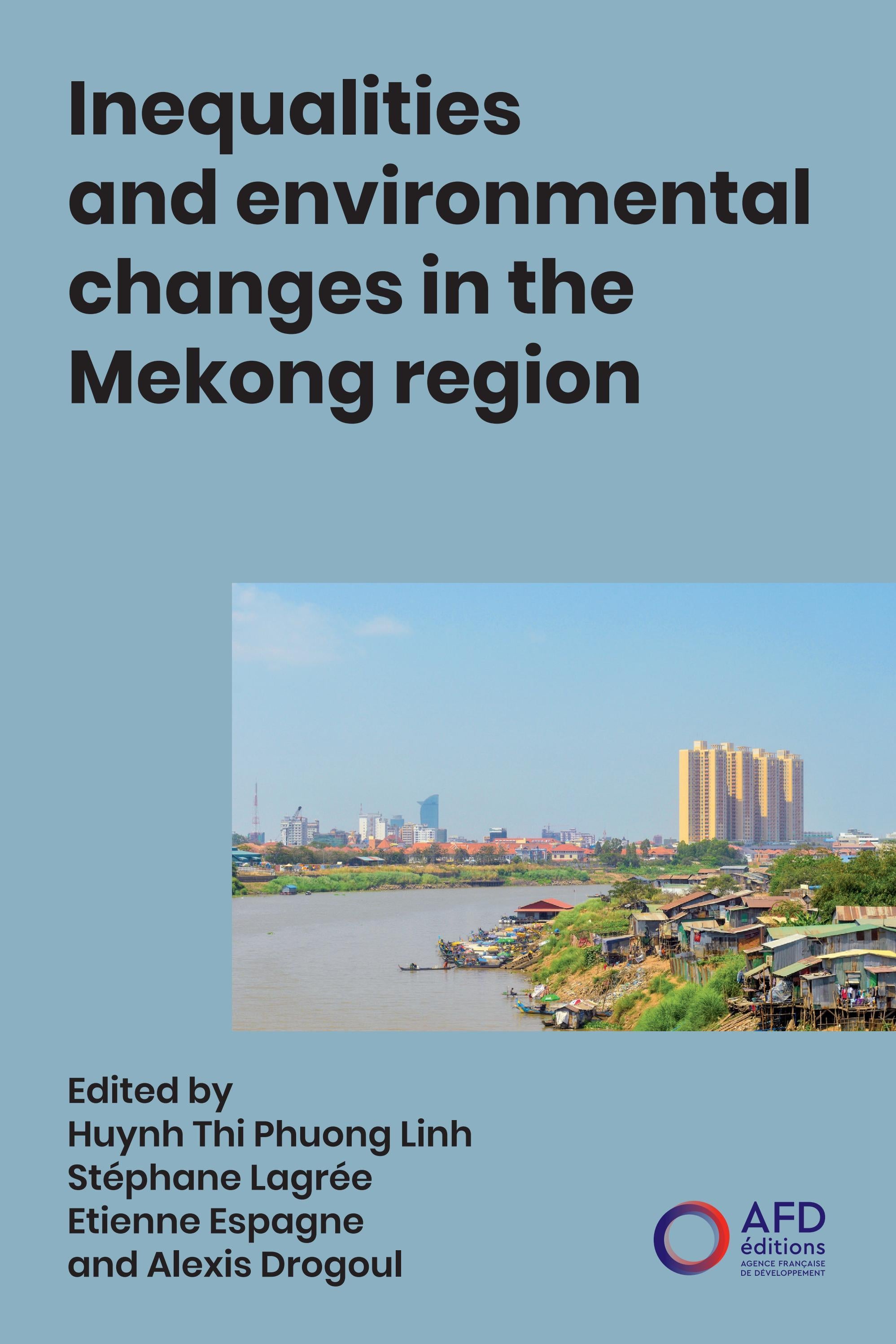

Inequalities And Environmental Changes In The Mekong Region By Agence Francaise De Developpement Issuu

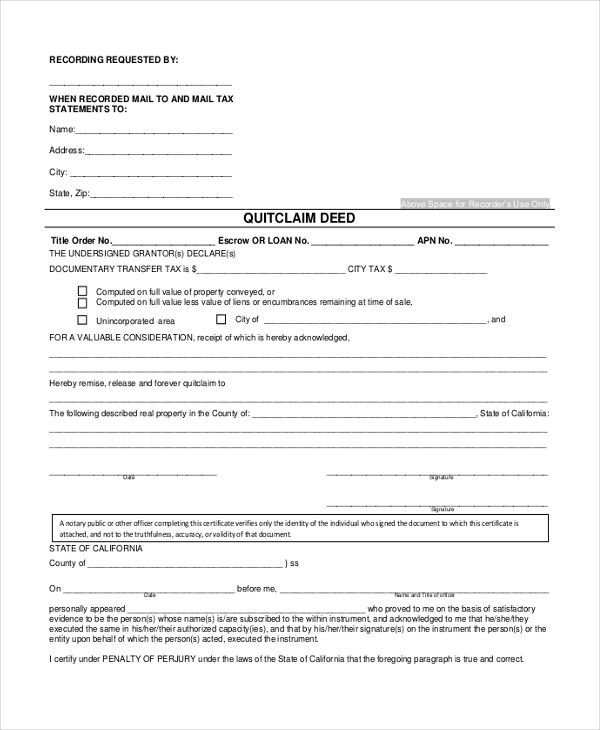

Free 10 Sample Quitclaim Deed Forms In Pdf Ms Word

Yerli Otomobilde Yeni Gelisme Izin Yolu Gurbetciler

Report On The Living Conditions Of Roma Households In Slovakia 2010 By United Nations Development Programme Issuu

Coming Home To Tax Benefits Windermere Real Estate

Mortgage Interest Deduction How It Calculate Tax Savings

How The Tcja Tax Law Affects Your Personal Finances

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu